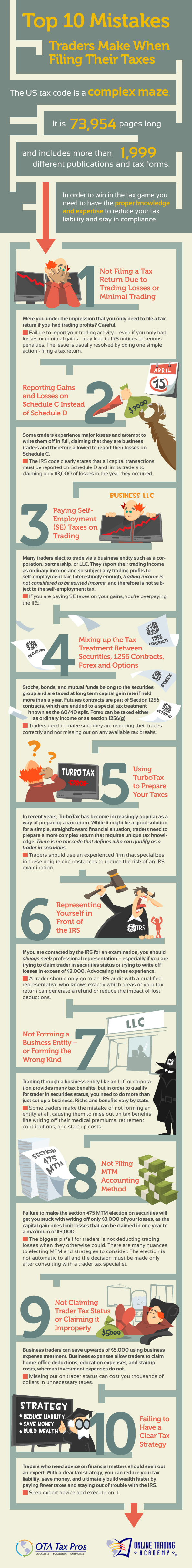

The Online Trading Academy in conjunction with their affiliate company, Tax Pros has created a list of common mistakes that many investors and traders make when they file taxes. The US tax code is a very complex book with over 1,999 different publications and tax forms. Despite the complexity of the various tax forms that is no excuse to not stay in the IRS’s good graces by knowing the laws inside and out.

Some traders feel that it isn’t necessary to file taxes for a specific year if no profit was incurred. This is false and failure to file taxes can result in serious penalties. On the other hand there are some who report their gains and losses on the wrong form and others who create business entities to avoid self-employment tax. View the infographic below to learn what to do to avoid making the same mistakes yourself.